LLM for Financial Services: Risk Analysis and Fraud Detection

DOI:

https://doi.org/10.5281/zenodo.14928807Keywords:

large language models (llms), gpt-3, finbert, risk analysis, fraud detection, financial servicesAbstract

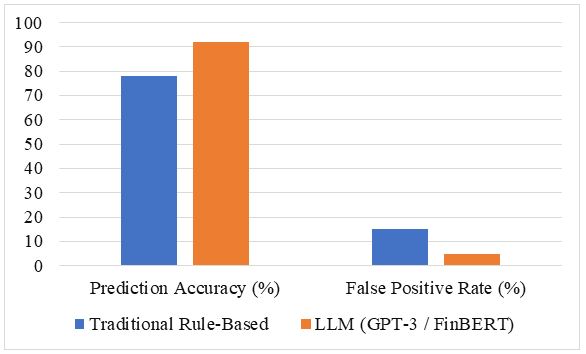

The financial service industry is increasingly suspected by risk management and complicated frauds, because of traditional methods, such as rules based on rules, becomes become Not enough to combat evolutionary threats. This study discovers the potential of large language models (LLM), including GPT-3 and Finbert, to improve risk analysis and fraud detection in the financial sector. LLM, capable of processing structured and non -structured data, provides improvement in detecting models and abnormalities between trading newspapers, customer interaction and talent reports main. A quantitative comparative comparative research design, financial data analysis can access the public and compare LLM performance with traditional systems. Main performance measures - Prediction Accuracy, False Positive Rate, Processing Time, and Fraud Detection Rate- are used to evaluate the effectiveness of the models. The results show the significant potential of LLM to improve financial risk management and detect fraud, provide an effective, accurate and developed approach to modern financial institutions.

Downloads

References

A. Desta. (2020). Analysis of the Ethiopian banks response. Bahir Dar University School of Law LLM Programme in Business and Corporate Law: A Research for Seminar on Contemporary Business Law Issues.

Bakumenko, K. Hlaváčková-Schindler, C. Plant, & N. C. Hubig. (2024). Advancing anomaly detection: Non-semantic financial data encoding with LLMs. arXiv preprint arXiv:2406.03614.

Cao, X. Yao, W. Gong, Y. Li, Y. Pan, J. Zhang, ... & C. Zhao. (2024). LLMs for insurance: Opportunities, challenges and concerns.

Chadalavada, T. Huang, & J. Staddon. (2024). Distinguishing scams and fraud with ensemble learning. arXiv preprint arXiv:2412.08680.

H. Zhao, Z. Liu, Z. Wu, Y. Li, T. Yang, P. Shu, ... & T. Liu. (2024). Revolutionizing finance with LLMs: An overview of applications and insights. arXiv preprint arXiv:2401.11641.

J. Chakraborty, W. Xia, A. Majumder, D. Ma, W. Chaabene, & N. Janvekar. (2024). Detoxbench: Benchmarking large language models for multitask fraud & abuse detection. arXiv preprint arXiv:2409.06072.

J. Xu, H. Wang, Y. Zhong, L. Qin, & Q. Cheng. (2024). Predict and optimize financial services risk using ai-driven technology. Academic Journal of Science and Technology, 10(1), 299-304.

Jimma. (2022). LLM in human rights and criminal law. Doctoral Dissertation, Jimma University.

K. Lakkaraju, S. E. Jones, S. K. R. Vuruma, V. Pallagani, B. C. Muppasani, & B. Srivastava. (2023). LLMs for financial advisement: A fairness and efficacy study in personal decision making. in Proc. Fourth ACM International Conference on AI in Finance, pp. 100-107.

Luca. (2024). Optimizing large language models for financial risk assessment in credit unions.

Lui, & N. Ryder, Eds. (2021). FinTech, artificial intelligence and the law: Regulation and crime prevention. Routledge.

M. Fan. (2024). LLMs in banking: Applications, challenges, and approaches. in Proc. International Conference on Digital Economy, Blockchain and Artificial Intelligence, pp. 314-321.

R. Pankajakshan, S. Biswal, Y. Govindarajulu, & G. Gressel. (2024). Mapping LLM security landscapes: A comprehensive stakeholder risk assessment proposal. arXiv preprint arXiv:2403.13309.

T. Park. (2024). Enhancing anomaly detection in financial markets with an LLM-based multi-agent framework. arXiv preprint arXiv:2403.19735.

W. Chang, S. Sarkar, S. Mitra, Q. Zhang, H. Salemi, H. Purohit, ... & C. T. Lu. (2024). Exposing LLM vulnerabilities: Adversarial scam detection and performance. in Proc. 2024 IEEE International Conference on Big Data (BigData), pp. 3568-3571.

Published

How to Cite

Issue

Section

ARK

License

Copyright (c) 2025 Vinoth Manamala Sudhakar

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Applied Science and Engineering Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.